The Role of Critical Minerals in Key Energy Transitions

Notes based on the IEA Report, May 2021.

-

Clean energy technologies considered in the report are as follows:

- Renewable power (solar photovoltaic [PV], onshore and offshore wind, concentrating solar power, hydro, geothermal and biomass)

- Nuclear power,

- Electricity networks (transmission and distribution),

- Electric vehicles,

- Battery storage

- Hydrogen (electrolysers and fuel cells).

-

All these technologies require metals and alloys, which are produced by processing mineral-containing ores. Ores – the raw, economically viable rocks that are mined – are beneficiated to liberate and concentrate the minerals of interest. Those minerals are further processed to extract the metals or alloys of interest. Processed metals and alloys are then used in end-use applications.

-

An energy system powered by clean energy technologies differs profoundly from one fuelled by traditional hydrocarbon (fossil fuel) resources—the transition to clean energy means a shift from a fuel-intensive to a material-intensive system.

- While solar PV plants and wind farms do not require fuels to operate, they generally require more materials than fossil fuel-based counterparts for construction.

- A typical electric car requires six times the mineral inputs of a conventional car.

- An onshore wind plant requires nine times more mineral resources than a gas-fired plant of the same capacity.

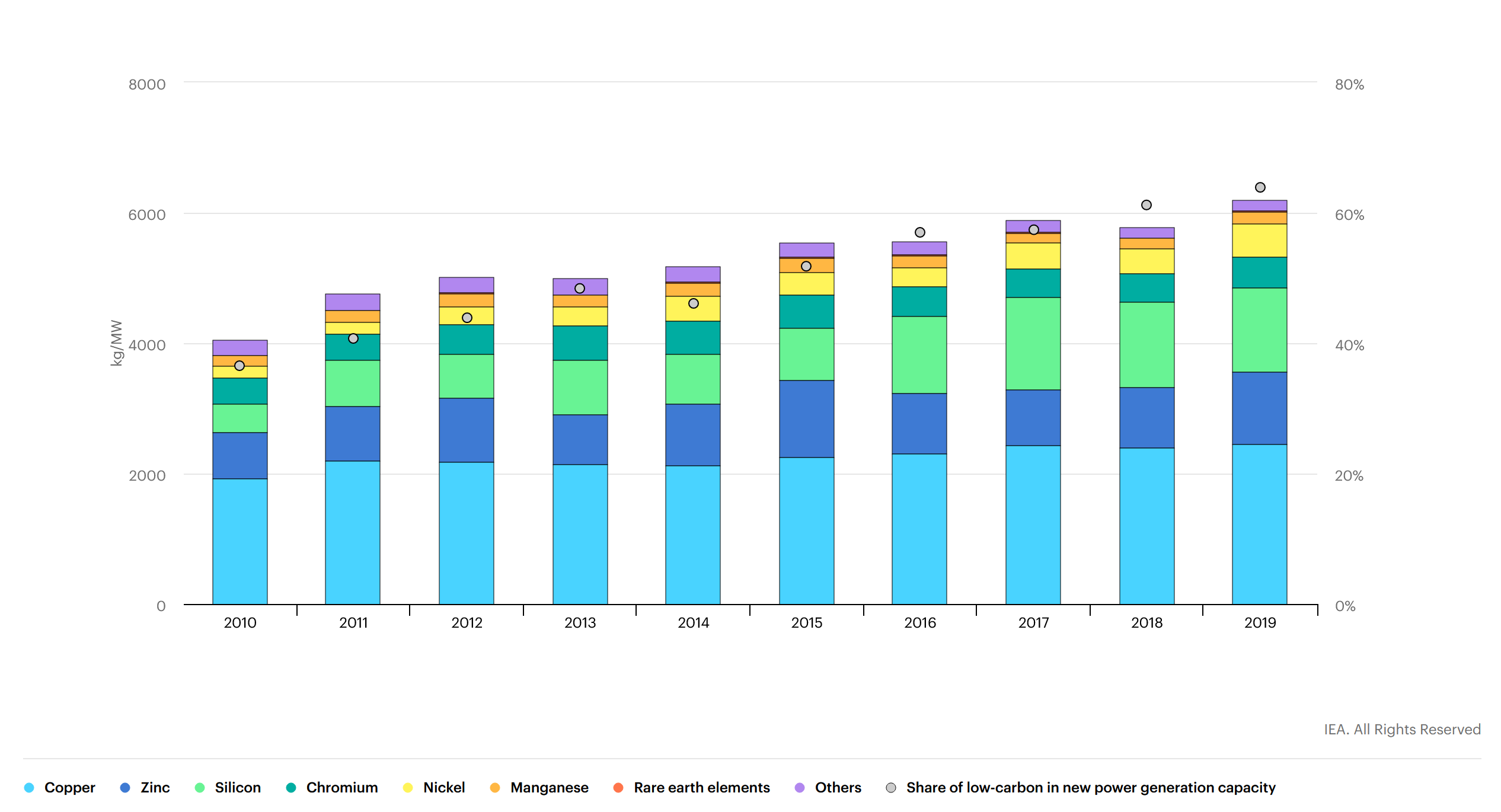

- Since 2010 the average amount of minerals needed for a new unit of power generation capacity has increased by 50% as renewables increase their share of total capacity additions.

The types of mineral resources used vary by technology:

| Mineral | Technology |

|---|---|

| Lithium, Cobalt, Nickel | Battery performance, longevity and energy density. |

| Rare Earth Elements (REEs) | Magnets for wind turbines and EVs. |

| Copper and Aluminium | Electricity networks. |

-

These characteristics of a clean energy system imply a significant increase in demand for minerals as more batteries, solar panels, wind turbines and networks are deployed.

-

Also means that the energy sector is set to emerge as a major force in driving demand growth for many minerals, highlighting the strengthening linkages between minerals and clean energy technologies.

-

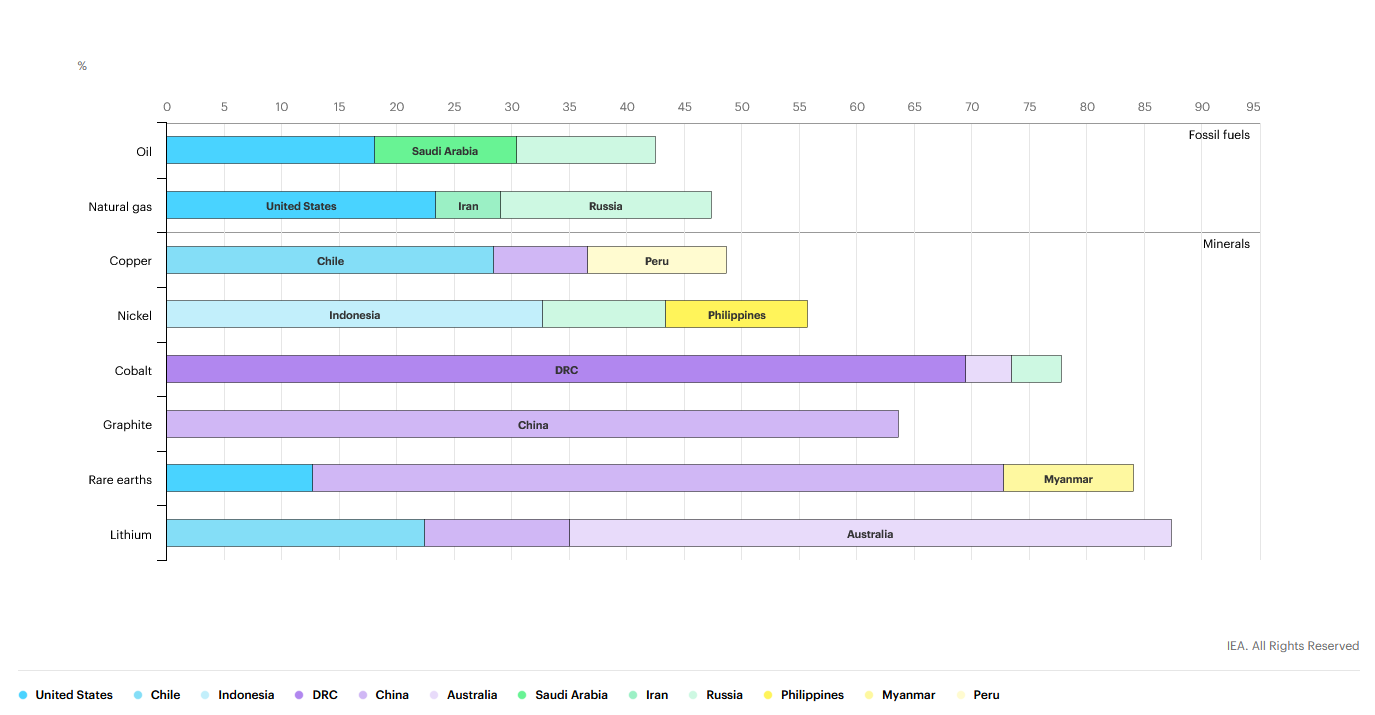

For lithium, cobalt and rare earth elements (REEs), the top three producing nations control well over three-quarters of global output. In some cases, a single country is responsible for around half of worldwide production.

- South Africa and the Democratic Republic of the Congo are responsible for some 70% of global production of platinum and cobalt respectively

- China accounted for 60% of global REE production in 2019

- The picture for copper and nickel is slightly more diverse, but still around half of global supply is concentrated in the top three producing countries.

-

The level of concentration is even higher for processing and refining operations:

- China’s share of refining is around 35% for nickel, 50-70% for lithium and cobalt, and as high as 90% for REE processing that converts mined output into oxides, metals and magnets.

-

This creates sources of concern for companies that produce solar panels, wind turbines, electric motors and batteries using imported

minerals, as their supply chains can quickly be affected by regulatory changes, trade restrictions or political instability in a small number of countries.

-

Traditional concerns over oil security (e.g. unplanned supply disruption or price spikes) are relevant for minerals as well. However, an oil supply crisis has broad repercussions for all vehicles that run on it. Consumers driving gasoline cars or diesel trucks are immediately affected by higher prices.

-

By contrast, a shortage or spike in the price of a mineral required for producing batteries and solar panels affects only the supply of new EVs or solar plants. Consumers driving existing EVs or using solar-powered electricity are not affected.

-

One of the major differences between oil and minerals lies in the way that they are used and recovered in the energy system.

- Unlike oil, which is combusted on an ongoing basis, minerals and metals are permanent materials that can be reused and recycled continuously with the right infrastructure and technologies in place.

- Compared with oil, this offers an additional lever to ensure reliable supplies of minerals by keeping them in circulation as long as possible.